Introduction:

Buying a car is a significant financial decision, and understanding car loan interest rates is crucial to making an informed choice. Interest rates directly impact the total cost of your loan, determining how much you'll pay over the life of the loan. A higher interest rate means you'll pay more in interest charges, while a lower rate can save you thousands of dollars. This guide will break down the key factors influencing car loan interest rates, helping you navigate the complexities of financing your next vehicle.

Factors Affecting Car Loan Interest Rates:

Several factors determine the interest rate you'll receive on a car loan. Understanding these factors can help you improve your chances of securing a favorable rate:

- Credit Score: Your credit score is the most significant factor influencing your interest rate. A higher credit score indicates a lower risk to lenders, resulting in a lower interest rate.

- Loan Term: The length of your loan term also impacts the interest rate. Longer loan terms generally come with higher interest rates, as you're borrowing money for a longer period.

- Loan Amount: The amount you borrow also plays a role. Larger loan amounts often come with higher interest rates, as lenders perceive them as riskier.

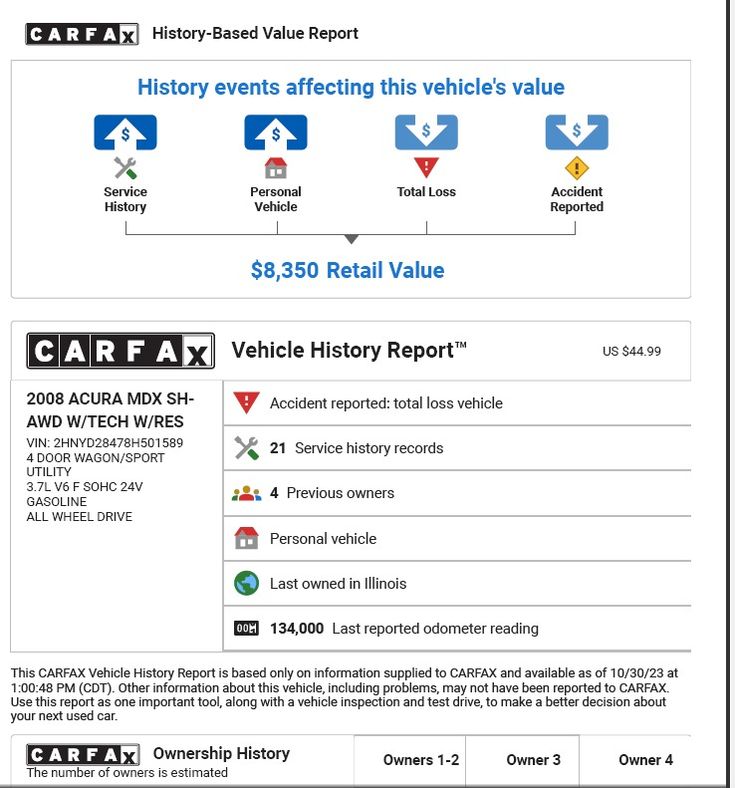

- Vehicle Type: The type of vehicle you're financing can influence the interest rate. New cars often have lower interest rates than used cars, as they are considered less risky.

- Lender: Different lenders have varying interest rate policies. Comparing offers from multiple lenders can help you find the best rate.

Tips for Getting a Lower Interest Rate:

- Improve Your Credit Score: Before applying for a loan, take steps to improve your credit score. Pay your bills on time, reduce your credit utilization, and avoid opening new credit accounts.

- Shop Around for Rates: Compare offers from multiple lenders to find the best interest rate. Online lenders often offer competitive rates.

- Consider a Shorter Loan Term: A shorter loan term can lead to a lower interest rate, as you'll be paying off the loan faster.

- Negotiate the Interest Rate: Don't be afraid to negotiate the interest rate with the lender. You may be able to secure a lower rate if you have a strong credit score and a good payment history.

- Consider a Pre-Approval: Getting pre-approved for a loan before shopping for a car can give you a better idea of your financing options and help you negotiate a better deal.

Conclusion:

Understanding car loan interest rates is essential for making informed financial decisions. By understanding the factors that influence interest rates and taking steps to improve your credit score, you can increase your chances of securing a favorable rate and saving money over the life of your loan. Remember to shop around, compare offers, and negotiate to find the best deal possible.